Product Guides

How to Track and See your Clients' Held-Away Digital Assets

![]() Published: 01/25/2024

Published: 01/25/2024

In the evolving landscape of financial planning, the surge in digital asset self-custody has introduced a pivotal change in how financial advisors interact with and manage client assets. Notably, a significant trend has emerged among younger investors: a preference for self-direction in managing digital assets. This shift has led to an increasing portion of clients' Assets Under Management (AUM) residing outside the traditional advisory relationship. Understanding and navigating this change is crucial for today's financial advisors.

The Challenge of Out-of-Sight Assets

The rise of digital assets, particularly in self-custody forms, poses a unique challenge for financial advisors. The dynamic nature of these assets, characterized by frequent transactions, trades, and interactions with decentralized finance (DeFi) protocols, can lead to significant fluctuations in cost basis, value, and portfolio composition. Traditional methods of financial planning, which might involve noting down balances at the beginning of the year, are proving inadequate. The fluidity of digital asset markets means that any static snapshot of a client’s portfolio quickly becomes outdated, leaving advisors in the dark about current holdings and values.

The Inefficiency of Traditional Tracking

Relying on annual or quarterly updates from clients about their digital asset holdings is not only inefficient but can lead to significant gaps in understanding a client's overall financial picture. Digital assets can change in value rapidly, and transactions can occur at any time, leading to a continuously evolving portfolio that is not captured by periodic updates. This information gap can have critical implications for financial planning, tax strategies, and risk management.

The Solution: Real-Time Wallet Tracking

To effectively manage and advise on clients' digital assets, financial advisors need to adopt tools that allow for real-time tracking of these holdings. By monitoring clients' digital wallets, advisors can instantly be alerted to position changes, price fluctuations, and any activity that might impact a client's financial plan, tax situation, or risk exposure. L1 Advisors enables advisors to track clients' digital assets in real-time. This is available in our free product tier and is the default access for any client you invite to the platform.

Benefits of Real-Time Tracking

- Enhanced Financial Planning: With real-time data, advisors can make more accurate and timely recommendations, ensuring that a client’s financial plan remains aligned with their current situation.

- Effective Tax Management: Real-time tracking allows for more precise calculations of capital gains or losses, enabling better tax planning and compliance.

- Risk Exposure Monitoring: Instant updates on portfolio changes help advisors quickly assess and respond to changes in risk exposure, especially important with volatile tokens.

- Client Confidence and Transparency: Providing clients with up-to-date information on their holdings fosters trust and transparency, essential components of a strong advisor-client relationship.

How to Track Clients' Digital Assets on L1:

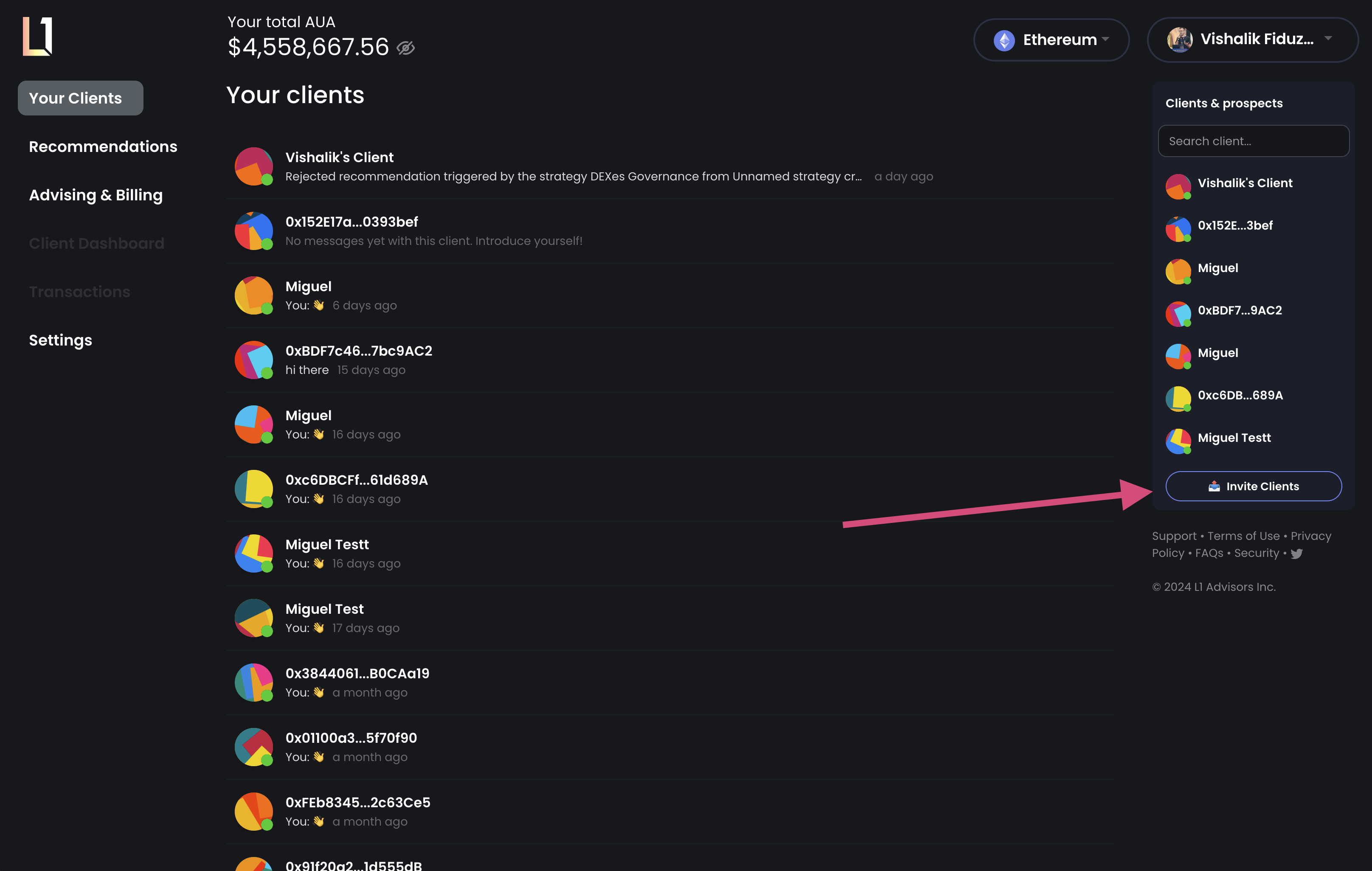

1. Locate the Invite Clients button on the right-hand sidebar

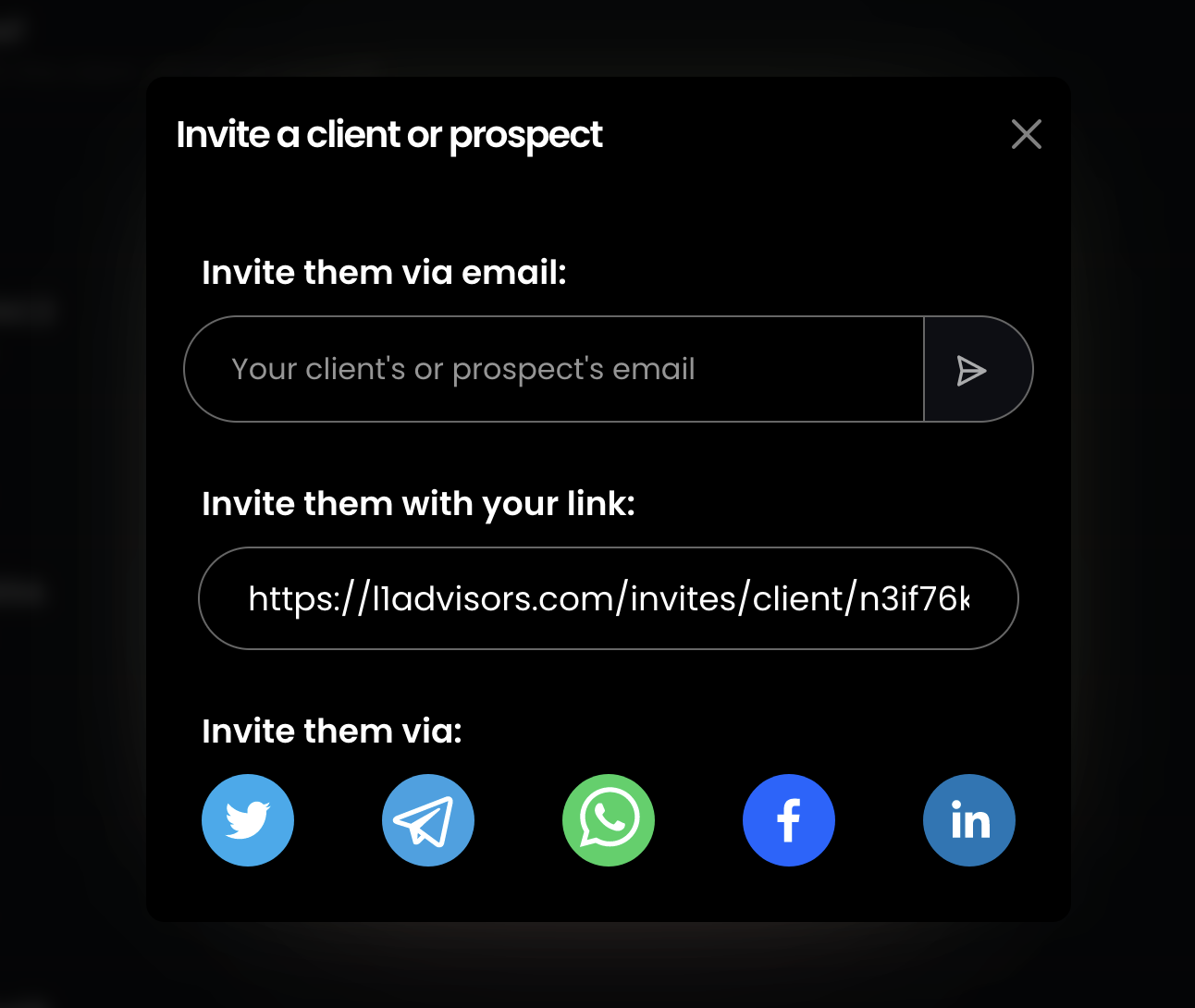

2. You can invite a client or prospect to join in two ways: via email, but entering their email, or by providing them with your invite link

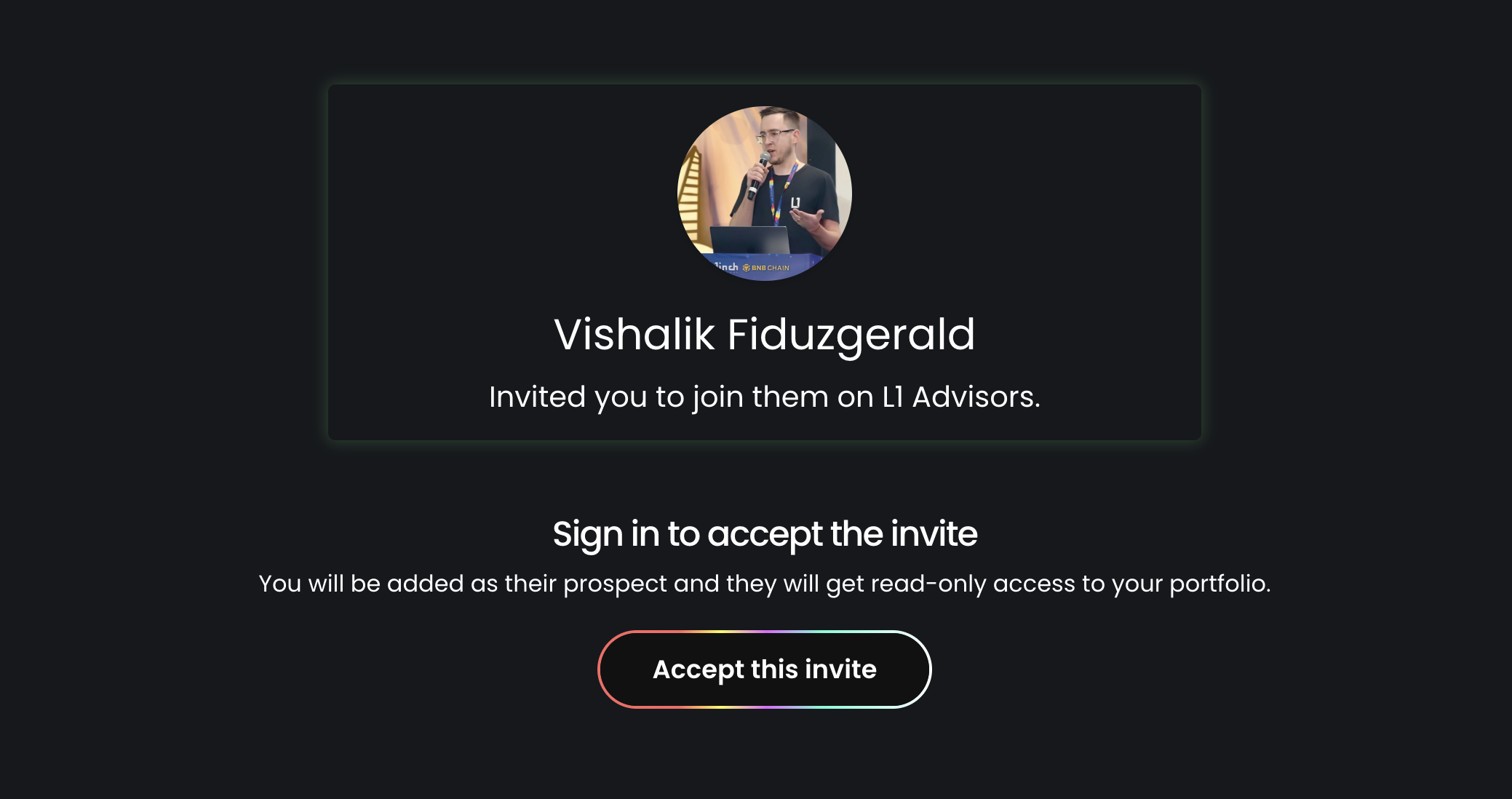

3. Once your client or prospect clicks on the invite link, they will land on a page that shows your name and photo, with a button to connect their wallet:

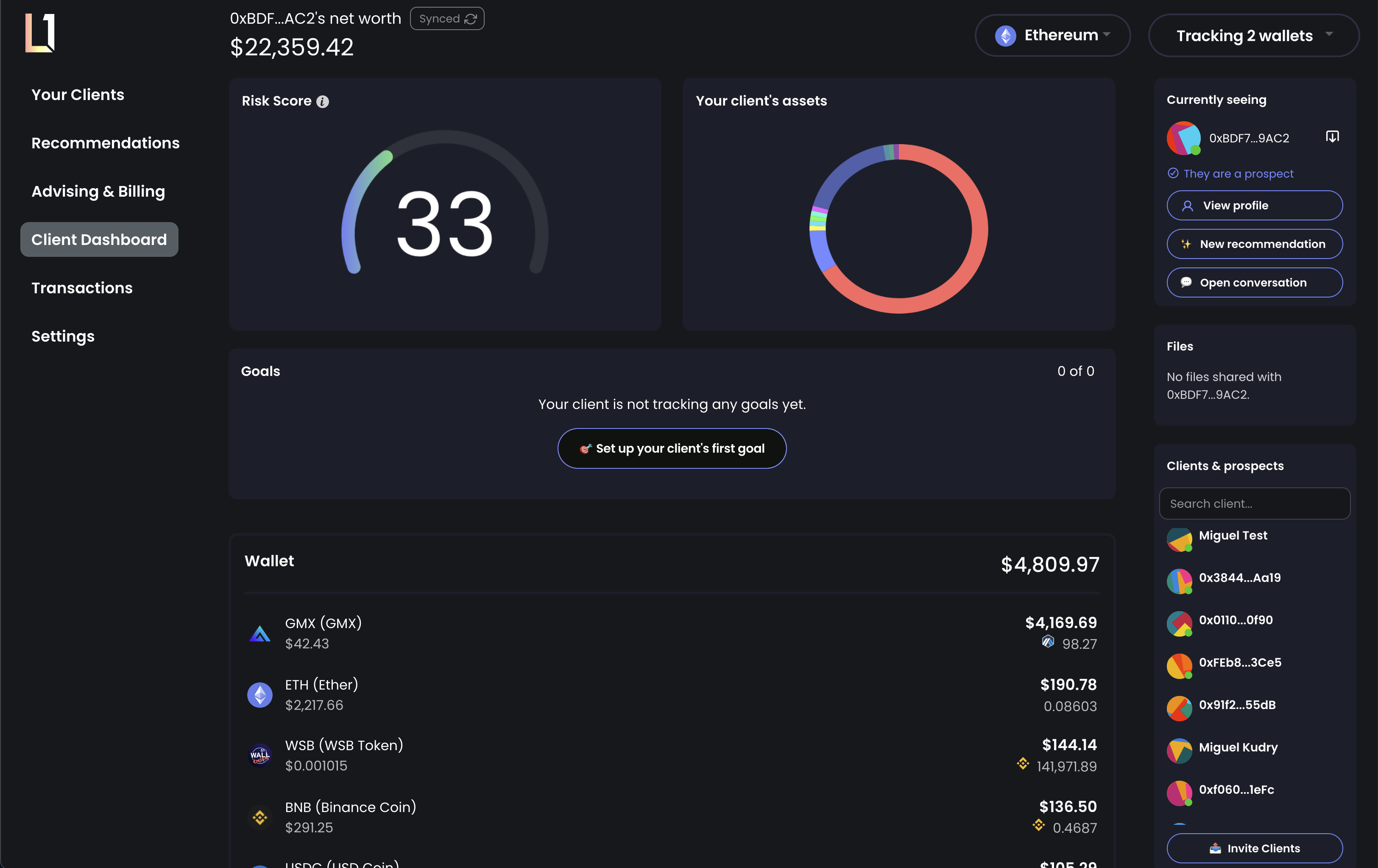

4. Once they sign into L1 with their wallet you will be instantly paired up and will be able to message each other on L1. They can add additional wallets to their account from their Settings, up to a total of 10 wallets, for free. L1 supports Ether and Bitcoin wallets. All wallets will appear on the dashboard and you will be able to see positions across all wallets in real-time:

5. You can even see assets and positions in specific wallets by hovering the dropdown on the very top right of the page and toggling specific wallets off and on. The dashboard and your client or prospect's net worth will update as you select or unselect wallets.

Embracing the Future

As digital assets continue to gain prominence and the trend towards self-custody grows, financial advisors must adapt to stay relevant and provide the best service to their clients. Embracing solutions like L1 Advisors to track and manage digital assets in real time is not just a competitive advantage; it is becoming a necessity in the modern financial advisory landscape.

Ready to take the next step? learn more about how to advise on held-away digital assets and grow your AUAs.