Product Guides

How to Advise on Clients' Held-Away Digital Assets and Grow Your AUAs

![]() Published: 01/26/2024

Published: 01/26/2024

Financial advisors are used to having full discretion over their client portfolios and assets. In the world of digital assets, and as more asset classes get tokenized, the percentage of non-discretionary assets in an advisor's practice will start to grow. Following our previous post on tracking your client’s held-away digital assets, the natural progression is to explore how you can actively advise on these assets.

From Tracking to Advising: The Path to Growing AUAs

Once you’ve started tracking your client's digital assets, the next step is to offer tailored recommendations. These recommendations can span a wide range of needs and strategies:

- Tax Optimization: You might suggest tax loss harvesting transactions, such as asset swaps, to optimize your client's tax situation.

- Strategy Implementation: Clients may seek guidance on tracking specific indexes or active strategies run by your RIA or by third-party index providers and asset managers listed on our platform.

- Risk Management: Monitoring risk and advising on rebalancing or profit-taking can be crucial, especially in the volatile digital asset market.

- Liquidity Solutions: In some cases, the most efficient liquidity solution might involve borrowing against digital assets like Bitcoin or Ether.

- Diverse Use Cases: The scope of advice can extend to decentralized finance (DeFi) activities like liquidity providing, bridging, or making payments.

Embracing Non-Custodial, Non-Discretionary Advising

With L1’s non-custodial platform, your advisory role is inherently non-discretionary. This approach can be an efficient compliance strategy in light of the SEC's proposed crypto custody rules, which impose stringent requirements on advisors with discretion or custody. By adopting a non-custodial, non-discretionary model, you can significantly reduce compliance overhead and time.

Key Benefits:

- Seamless Integration: Clients can add their digital assets to the advisory relationship without transferring or giving up custody, lowering barriers to your value addition.

- Compliance Efficiency: Avoiding custody and discretion simplifies compliance, an advantage under the evolving regulatory landscape.

- Access to Innovative Finance: Self-custody opens the gateway to decentralized finance, exposing clients to cutting-edge protocols and tokenized asset classes like private credit and real estate all available through the L1 platform.

- Alignment with Client Preferences: This approach resonates with the self-directed preferences of younger investors, aligning with their desire for a coaching and mentoring relationship with their advisor.

Setting and Managing AUA Fees on L1

L1 empowers you to set your AUA percentage fee. Our platform streamlines comprehensive reporting, accrual of fees, and invoicing in a compliant manner. Integrations with back-office software such as BlackDiamond, Salesforce, and Orion align with your existing software stack and operations, allowing you to focus more on client relationships and less on administrative tasks.

How to Go from Tracking to Advising

While tracking is completely free, advising on client assets is part of our paid product tier. Before we go into our pricing, here is a step-by-step guide on how to go from tracking to advising, which is also the moment your clients begin to accrue your AUA fee.

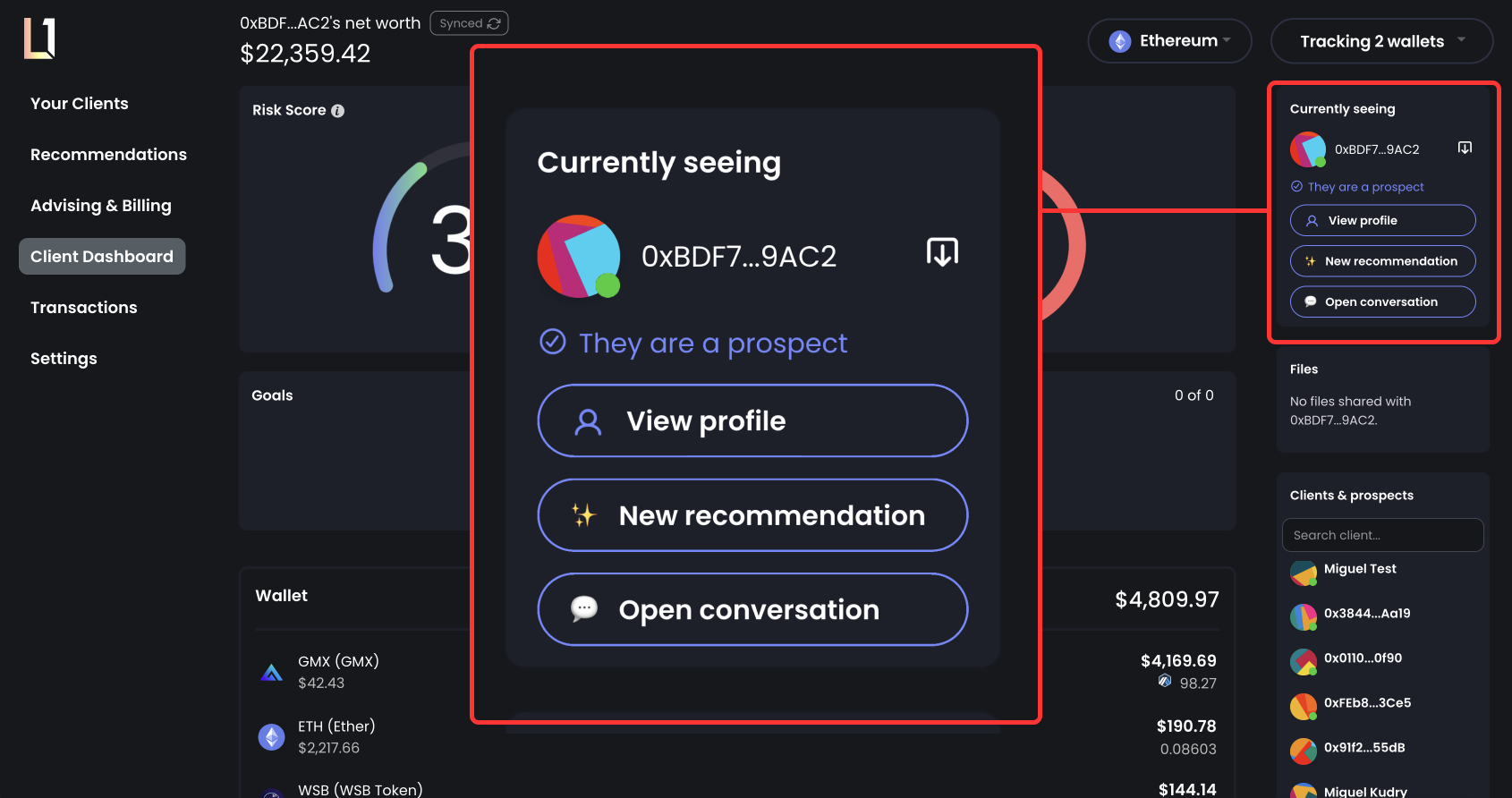

1. It all starts on your list of clients. When you select a client, you'll see whether you are advising any of their wallets or not:

When you select someone on your list, we'll show you whether they are a prospect or whether you are advising on any of their wallets. Prospects are those people whose assets you are just tracking. In this example, this person is a prospect.

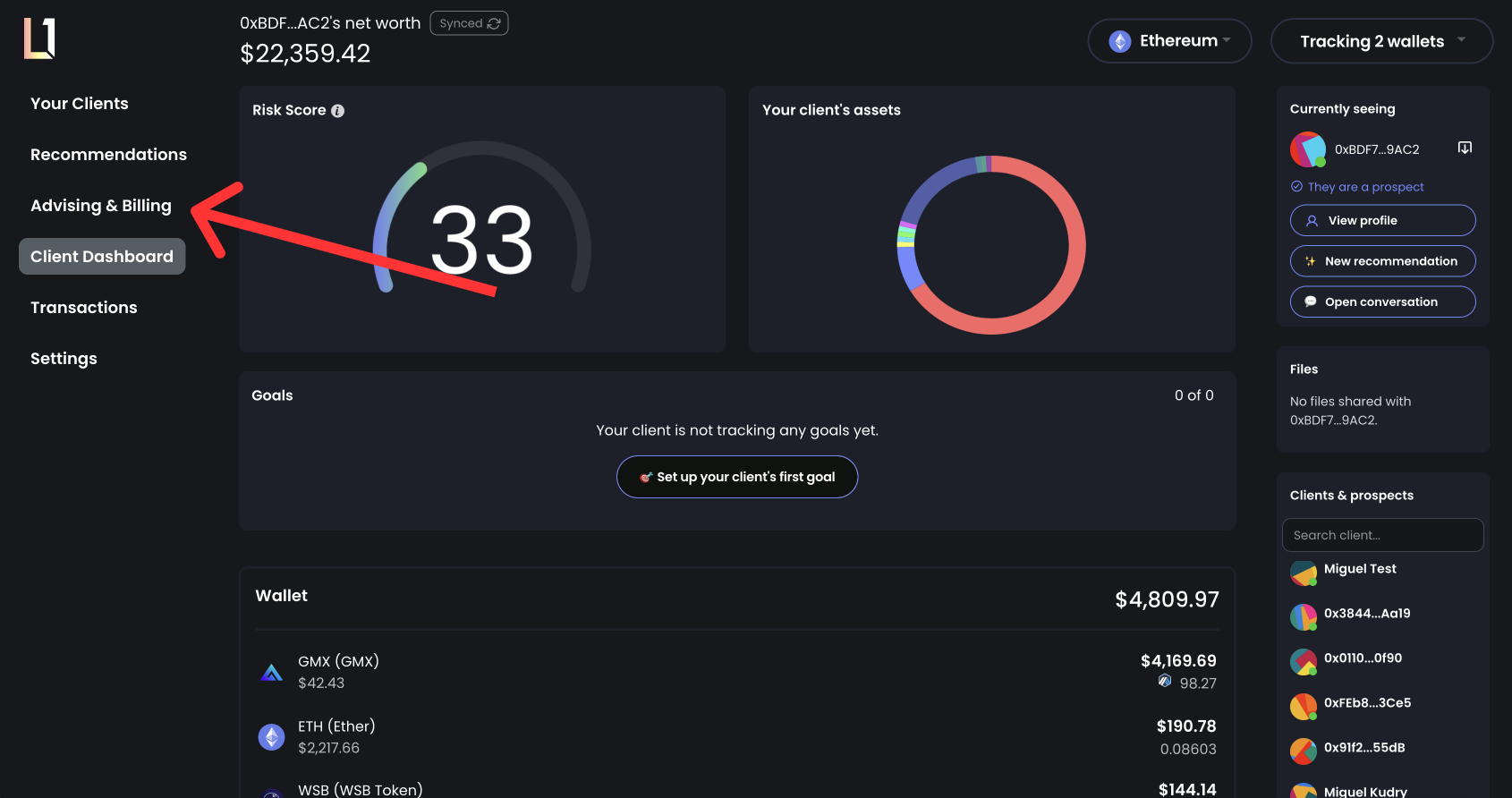

2. To start advising a prospect's wallet, you need to request advising access first. To do that, head over to the Advising & Billing tab:

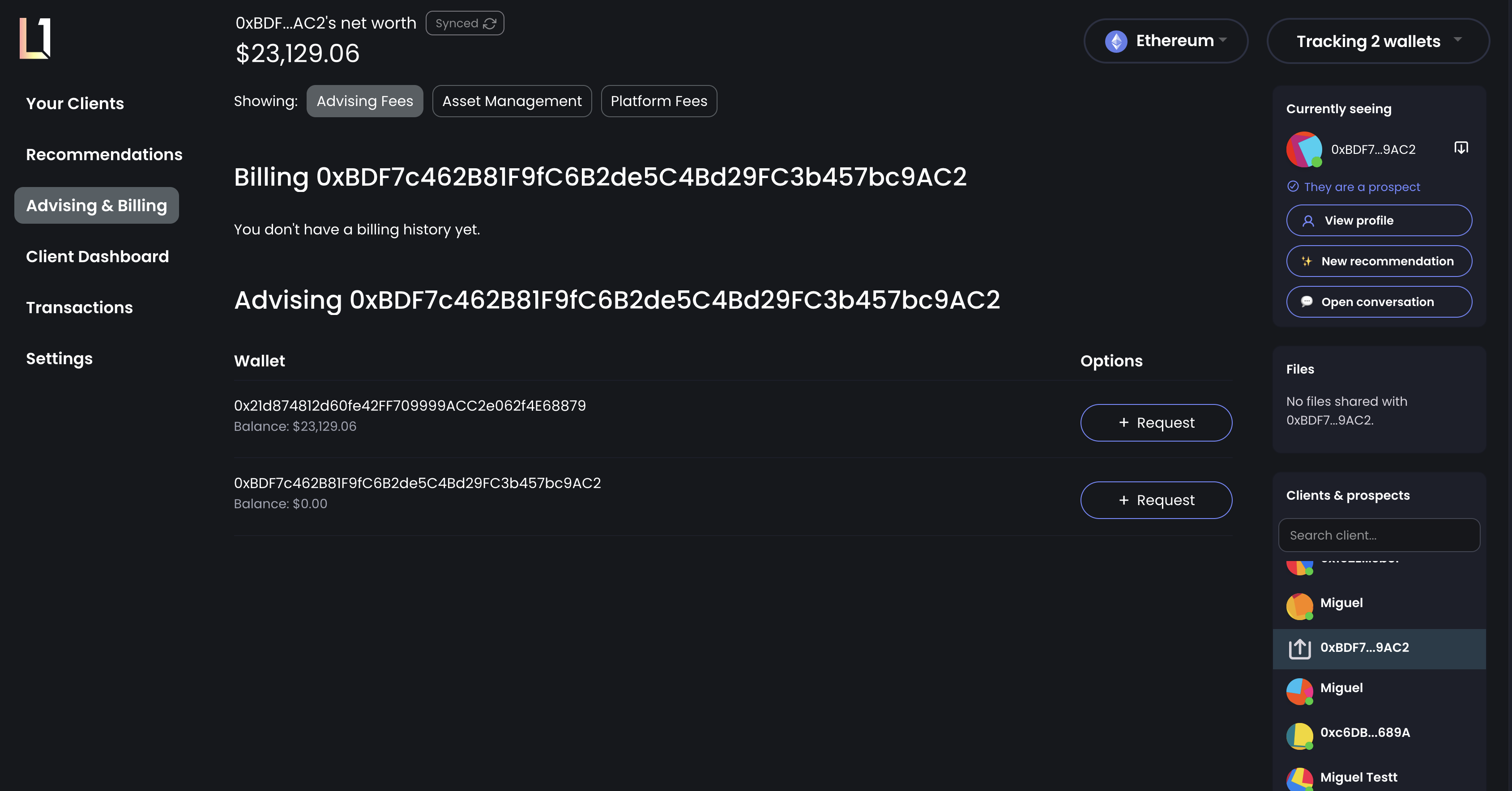

From there, you will be able to see a list of your prospect's wallets:

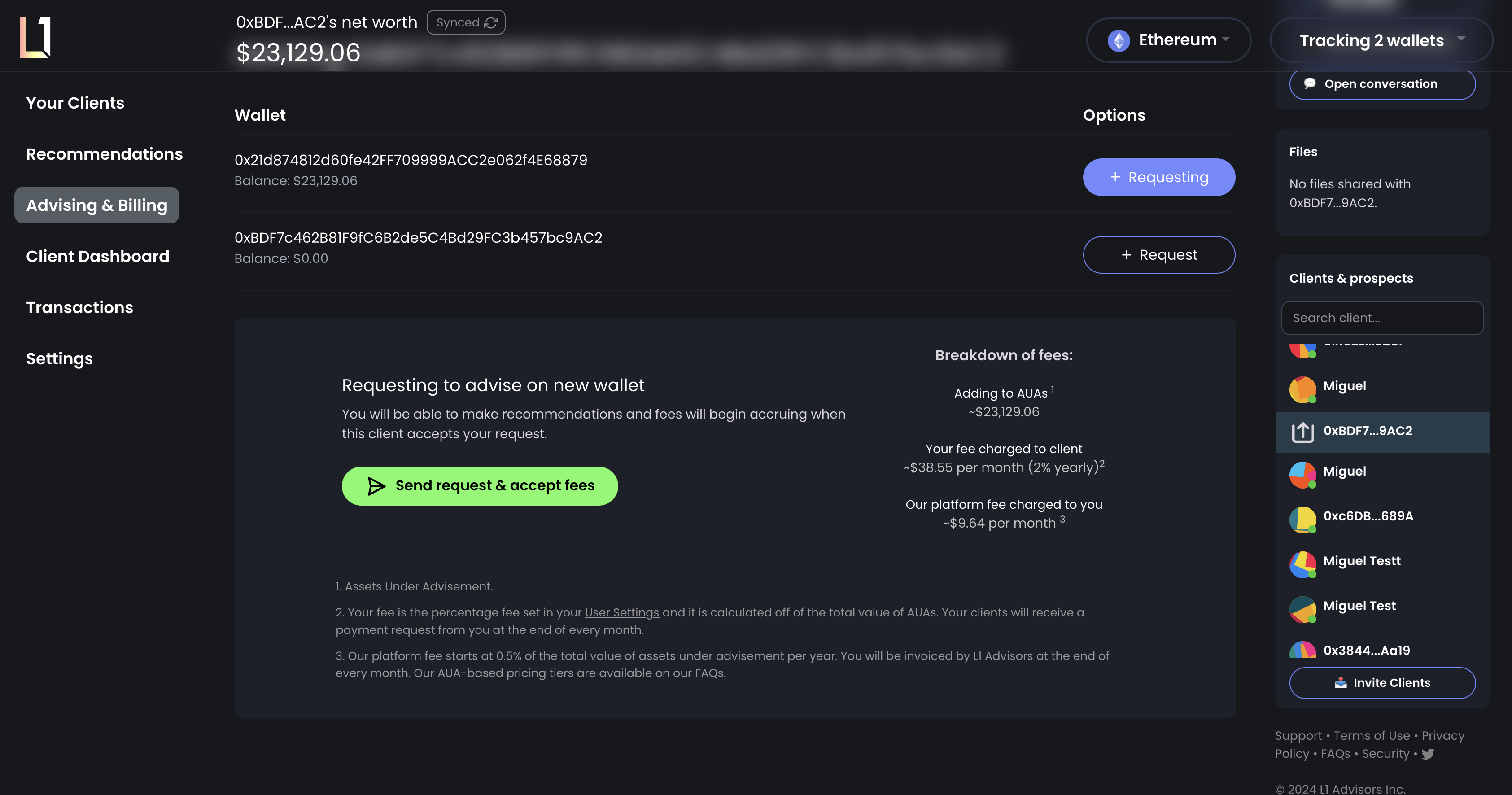

3. You can request advising access to one or more wallets at a time. Select those you want to request advising access, review the breakdown of fees, and send the request. At this point, your client will be notified and asked to review your request.

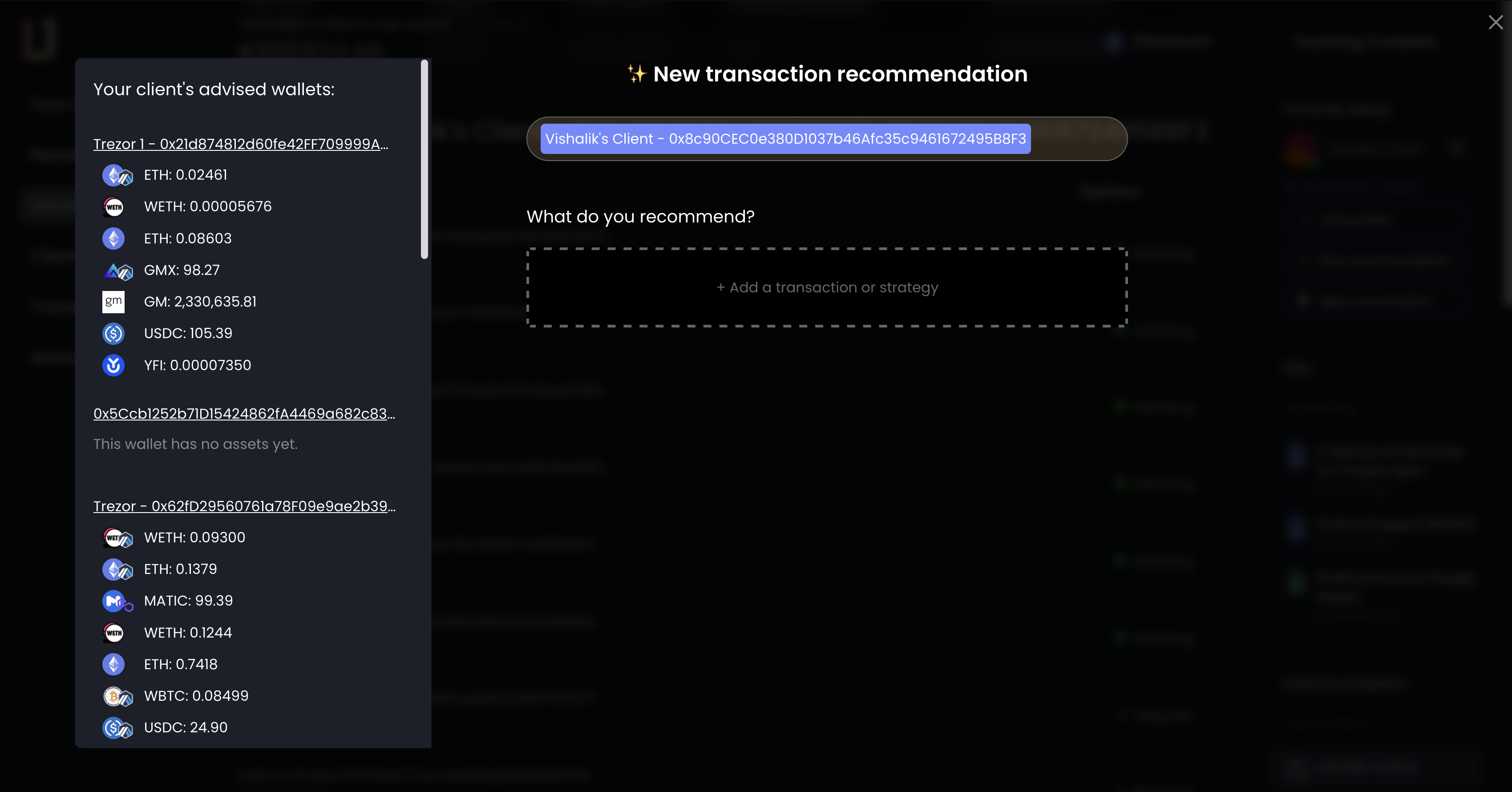

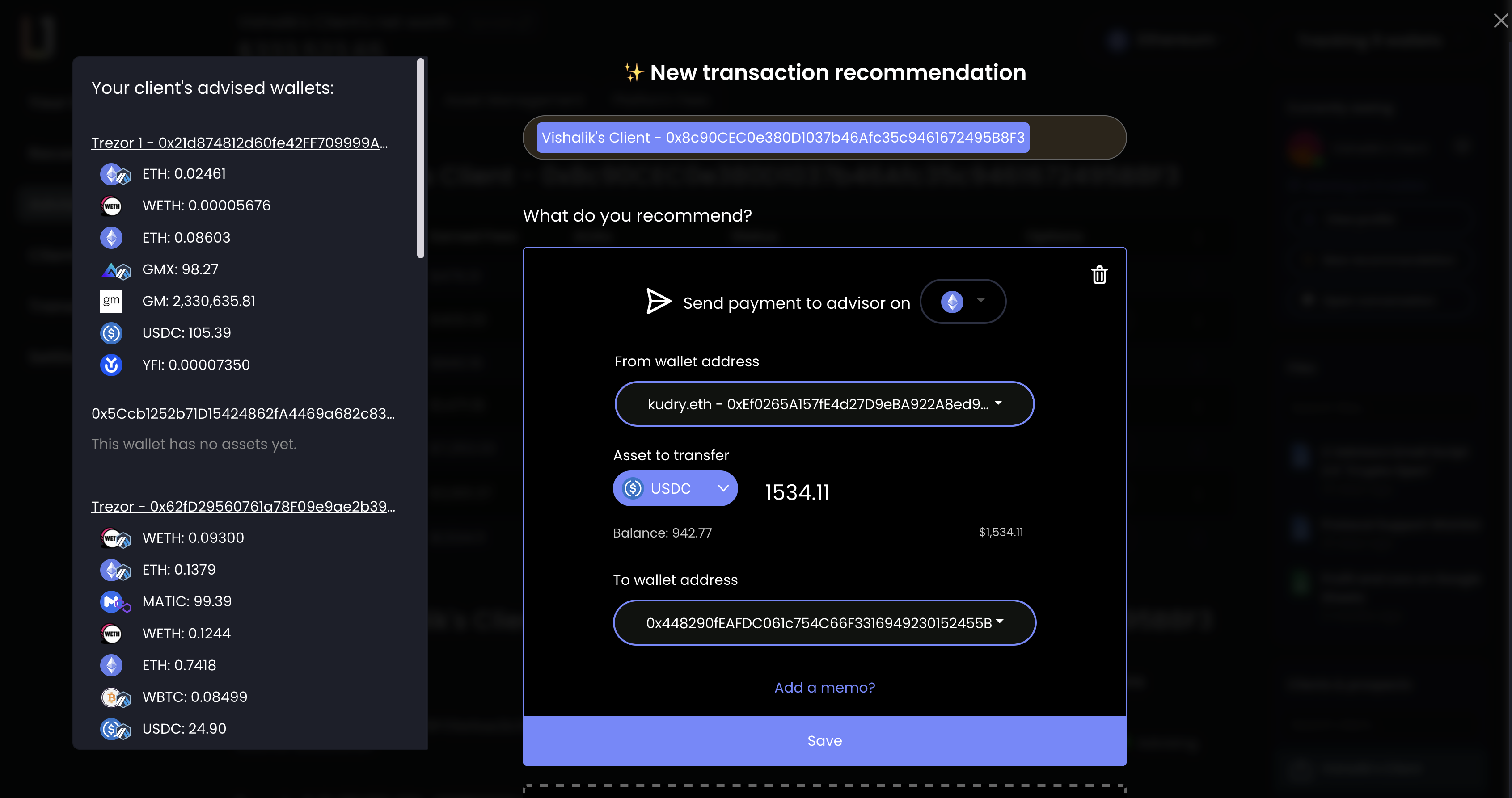

4. You'll be able to start making recommendations to your new client as soon as they accept your advising request. To do that, select the "New recommendation" button on your selected client section on the top right-hand side of the page after selecting your client. This will open up the transaction recommendation builder.

The transaction builder has three main components: the left-hand sidebar containing the list of wallets you have advising access to, with a breakdown of assets; the recipient(s) of the recommendation, and the recommended transaction(s).

To start putting together a recommendation, simply click the empty recommendation box to see the protocols and strategies available to recommend.

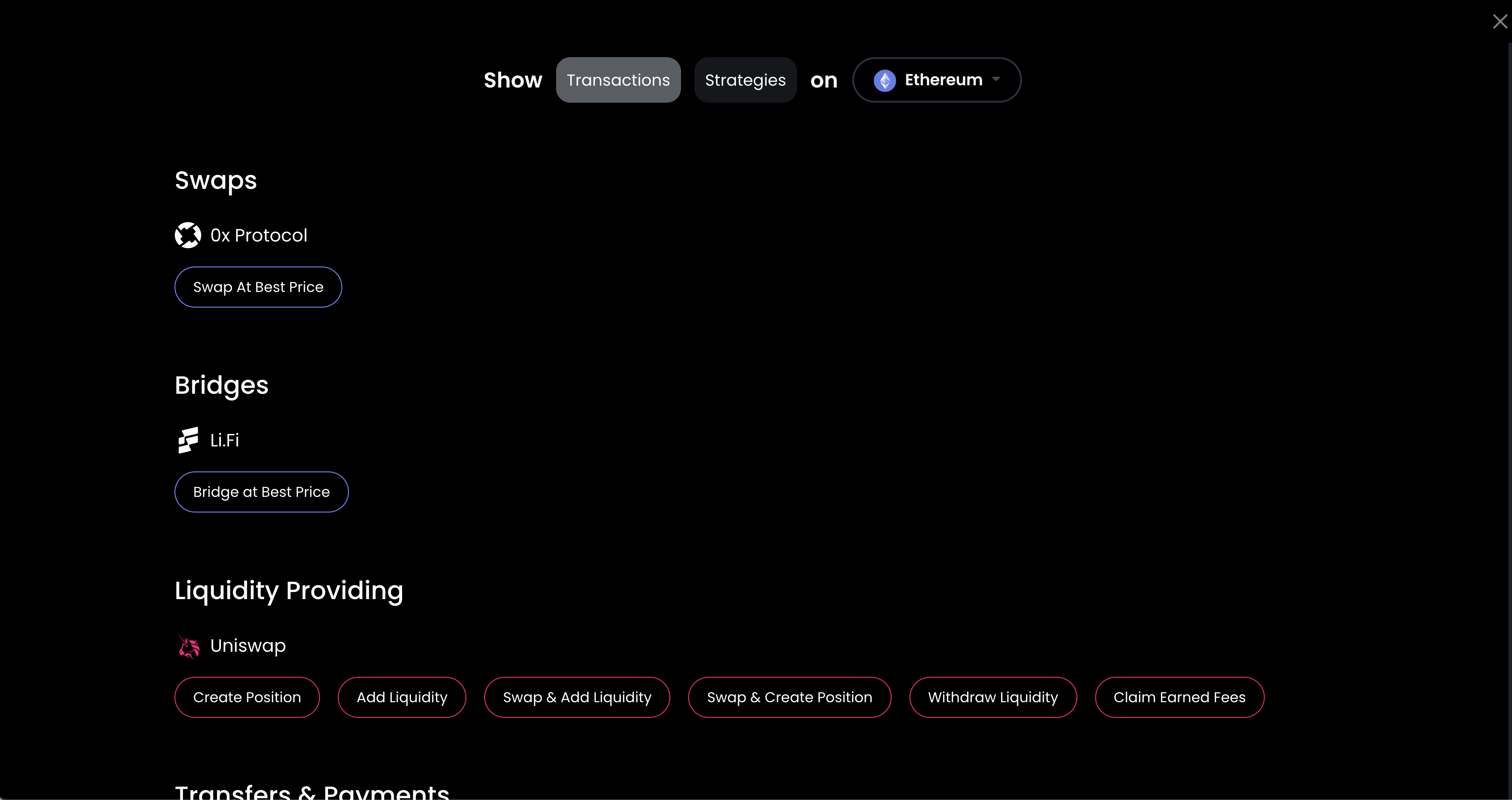

The first tab (Transactions) shows you specific and individual transactions you can recommend ranging from swaps, rebalances, transfers, liquidity providing, and more. These are one-time transactions that can be combined with others. You can send multiple transaction recommendations at the same time.

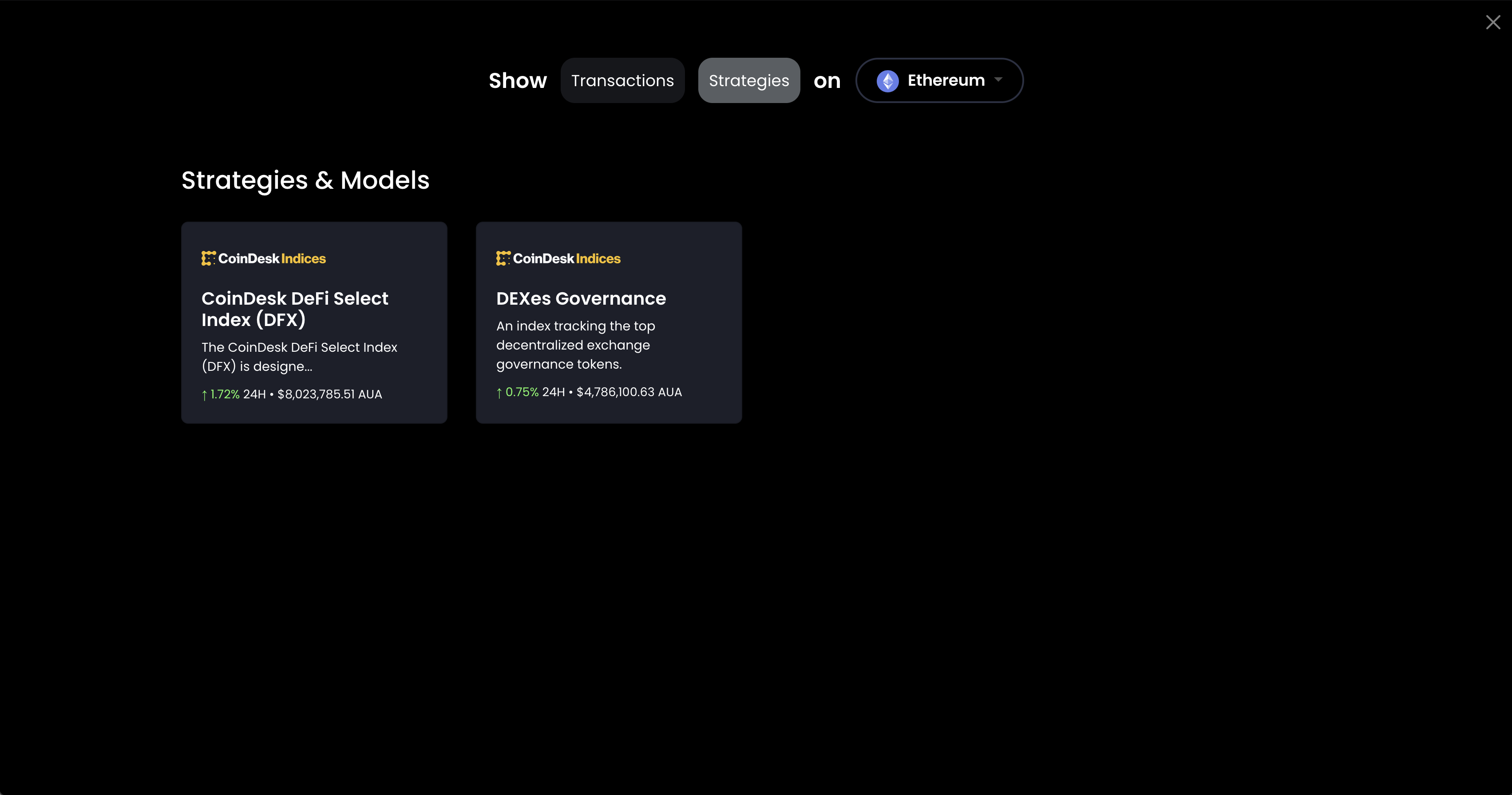

The second tab (Strategies) shows you passive indexes and active strategies managed by third-party index providers and asset managers. These are different from those in the Transactions tab as you will recommend your clients to subscribe to these indexes or strategies from one or more of their wallets. Subscriptions to strategies automatically trigger recommendations for your clients every time there is a rebalance or change in a strategy, or any time your client makes a transaction on their own resulting in a different balance from a subscribed wallet, which will automatically trigger a rebalance and new transaction recommendations to be sent.

AUAs are the New AUMs

As a financial advisor, embracing a non-custodial, non-discretionary approach not only positions you at the forefront of digital asset management but also aligns you with the preferences and needs of your future client base. With the L1 platform, you can start growing your AUAs and start generating AUA fees in a compliant and efficient way.

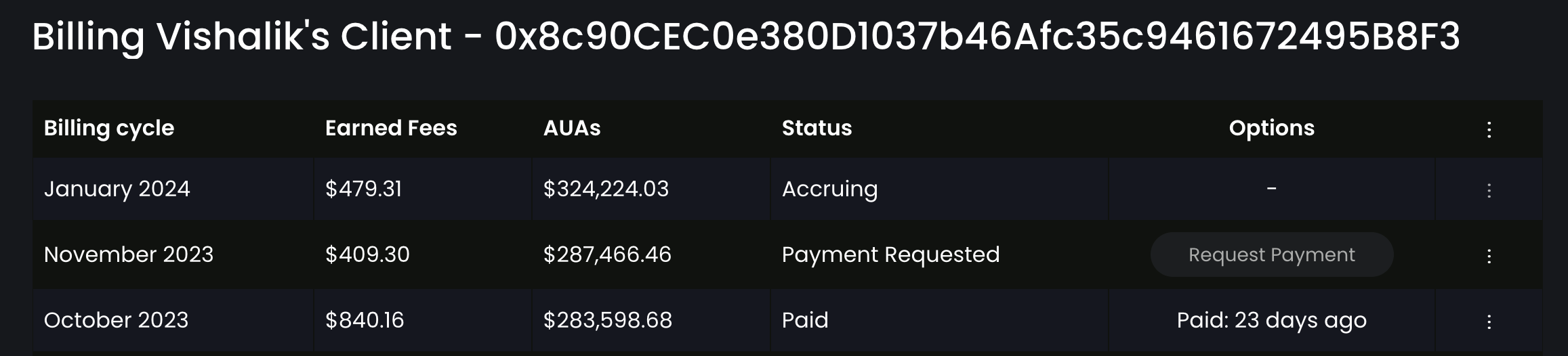

The moment a client accepts your advising request, L1 begins to accrue your AUA fee daily based on your advised wallet's asset values. This aggregate of asset balances is what we call your Assets Under Advisement (AUAs). L1's platform fee begins to accrue at the same time, which starts at 0.5% of AUAs per year and goes down to 0.2% as you grow your AUAs. For more information on L1's platform fees, visit our FAQs.

At the end of every month, L1 will generate and send each of your clients an invoice from your firm with a breakdown of fees. You can see invoices, payment status, as well as request payment from your clients from the Advising & Billing tab:

You can request a payment for fees through L1, in which case we'll update your invoice as paid upon payment by your client, or you can charge clients outside of L1 (i.e. from a cash account you have discretion over) and simply manually mark fees as paid on L1.

And that's it! You are now well equipped to advise on held-away digital assets in a compliant way, without ever needing custody of those assets. You can reach out to our team of specialists below if you have any additional questions.