Advisor Guides

A Financial Advisor's Ultimate Guide to Self-Custody

![]() Published: 01/05/2024

Published: 01/05/2024

In this video, we are joined by Nick Rygiel from Ironclad Financial.

The landscape of digital asset management is distinctly marked by two paradigms: Centralized Finance (CeFi) custody and self-custody. CeFi custody involves entrusting digital assets to centralized platforms such as exchanges, financial service providers, or, for institutional clients, qualified custodians.

Clients who opt for CeFi platforms place their assets under the control of these centralized entities. While CeFi providers have successfully brought millions of new self-directed investors into the market due to their convenience, they often come with limitations in offerings, potentially higher costs, and in extreme cases, risk of liquidity issues and insolvencies, as seen with FTX, Celsius, and BlockFi. These incidents highlight potential risks inherent in CeFi custody, including security challenges and the risk of platform-specific problems. However, it's essential to recognize that these events are not reflective of the entire CeFi sector, which continues to evolve with enhanced security and management practices.

In comparison, self-custody offers an alternative where users have direct control over their digital assets. This model provides more autonomy, as it eliminates reliance on third-party security and operational practices. While self-custody minimizes risks related to platform-specific problems, it does place more responsibility on the individual for the security and management of their assets.

Both CeFi and self-custody models have their distinct set of risks and advantages. The choice between them often depends on the user’s comfort with taking on personal responsibility for asset management, their trust in centralized platforms, and their risk tolerance.

In the evolving landscape of digital assets, understanding self-custody is essential for financial advisors and compliance professionals. This guide provides a comprehensive overview of self-custody, its benefits, requirements, and guidance for advisors to offer their clients.

Understanding Crypto Self-Custody

Crypto self-custody refers to individuals or entities holding their digital assets in their wallets, without third-party intermediation, contrasting with CeFi custody where assets are held by a centralized entity. There are two types of self-custody wallets, and L1 Advisors supports both of them:

- Hardware Wallets: Physical devices like Trezor and Ledger, storing private keys offline.

- Software Wallets: Applications installed on computers or smartphones, more convenient but less secure than hardware wallets.

Multi-Signature Wallets

Multi-signature (sometimes called "multi-sig") wallets like Gnosis Safe require multiple signers to authorize a transaction, offering extra security, and enabling new governance models that support more sophisticated requirements, such as those of a family office or trust. Both software and hardware wallets, or a combination thereof, can be used as multi-sig wallet signers. You can use L1 with a multi-sig wallet like Gnosis Safe by connecting to it using WalletConnect.

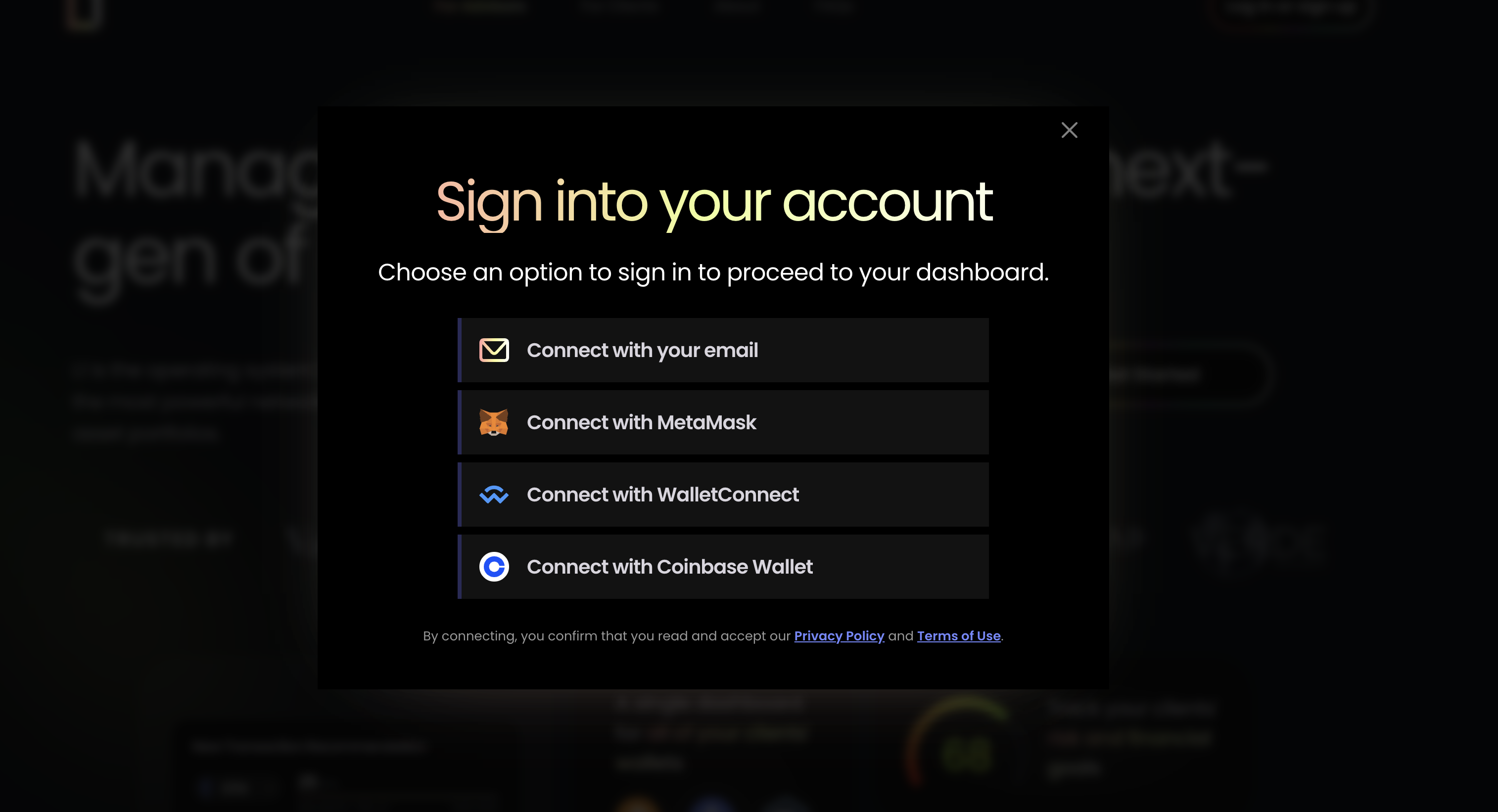

There are different ways to connect your wallet with L1. In all scenarios, a client's private key stays with them at all times. Neither L1 nor financial advisors can ever execute transactions on behalf of a client, let alone access their funds in any way. The following are L1 Advisors' supported wallets:

- Magic Link: Generates a wallet associated with your email. Clients only need to authenticate with their email address and do not have to worry about managing private keys unless they want to move their funds to a different wallet. They simply sign in with their email and instantly get access to their wallet.

- Coinbase Wallet: Connects to L1 from the Coinbase app or the standalone Coinbase Wallet app. This is an easy way to onboard clients who already have a Coinbase account as they can easily withdraw assets from Coinbase to their Coinbase Web3 Wallet.

- WalletConnect: Connects to a wide range of mobile and desktop wallets.

- MetaMask: Creates hot wallets (which keep private keys online and encrypted on the client's desktop or mobile device) or acts as an interface with L1 for hardware wallets (which keep private keys offline and on the hardware wallet, not on the computer).

Benefits and Considerations of Self-Custody

The main benefits of self-custody are control over digital assets, access to decentralized financial protocols that can provide yield and other opportunities to lend, borrow, stake, and access cutting-edge solutions, and overall reduced fees by removing middlemen and gatekeepers. However, it comes with the responsibility of managing private keys and security.

Client Suitability for Self-Custody

Advisors should consider a client's technical expertise, security awareness, and investment size when determining their suitability for self-custody. A diversified approach using hardware and software wallets is also recommended, balancing security with convenience as well as where on their investment journey each client is.

Compliance Considerations in Light of the SEC's Crypto Custody Rules

The SEC's rules on crypto custody emphasize the need for advisors to work with qualified custodians, impacting discretion over custody. Self-custody allows advisors to non-discretionarily advise on clients’ held-away digital assets without moving assets to a third-party custodian. This approach reduces the compliance overhead required by the SEC of advisors who have discretion or custody, making self-custody a beneficial compliance strategy.

Advantages of Self-Custody in Compliance

- Reduced Compliance Overhead: Avoids the need for clients to move assets to a third-party custodian.

- Non-Discretionary Advisory: Allows advisors to advise on digital assets without exercising discretion over custody.

- Regulatory Alignment: Aligns with SEC requirements while offering clients control over their digital assets.

Self-custody in digital asset management offers control, autonomy, and a strategic compliance advantage. For financial advisors and compliance professionals, understanding and guiding clients through self-custody options is crucial in providing informed, secure, and regulatory-compliant advice. Embracing self-custody is also a gateway to a new generation of crypto-native clients who are generally self-directed, and, increasingly self-custodied.